Catch Up Limit 2025. Increases catch‑up limits to the greater of $10,000 ($5,000 for simple plans) or 50% more than the regular catch‑up amount in 2025 for individuals who have attained ages 60, 61,. Beginning in 2025, the limit for that group is equal to the greater.

In 2025, the contribution limit for employees who participate in traditional 401(k) plans is $23,000 a year if you’re younger than 50. Those who are age 60, 61, 62, or 63 will soon be able to.

2025 preliminary inseason landings for species with stock annual catch limits (acl) date 2025 commercial landings through:

Higher CatchUp Contribution Limits in 2025 YouTube, Consumer product safety commission said it received reports of eight deaths and an estimated 9,700 injuries. Most employers allow employees age 50 and over to make additional contributions.

2025 Catch Up Limit Camel Corilla, Beginning in 2025, the limit for that group is equal to the greater. 401k calculator with catch up contributions, that compares with the $500 boost seen in 2025 over 2025.

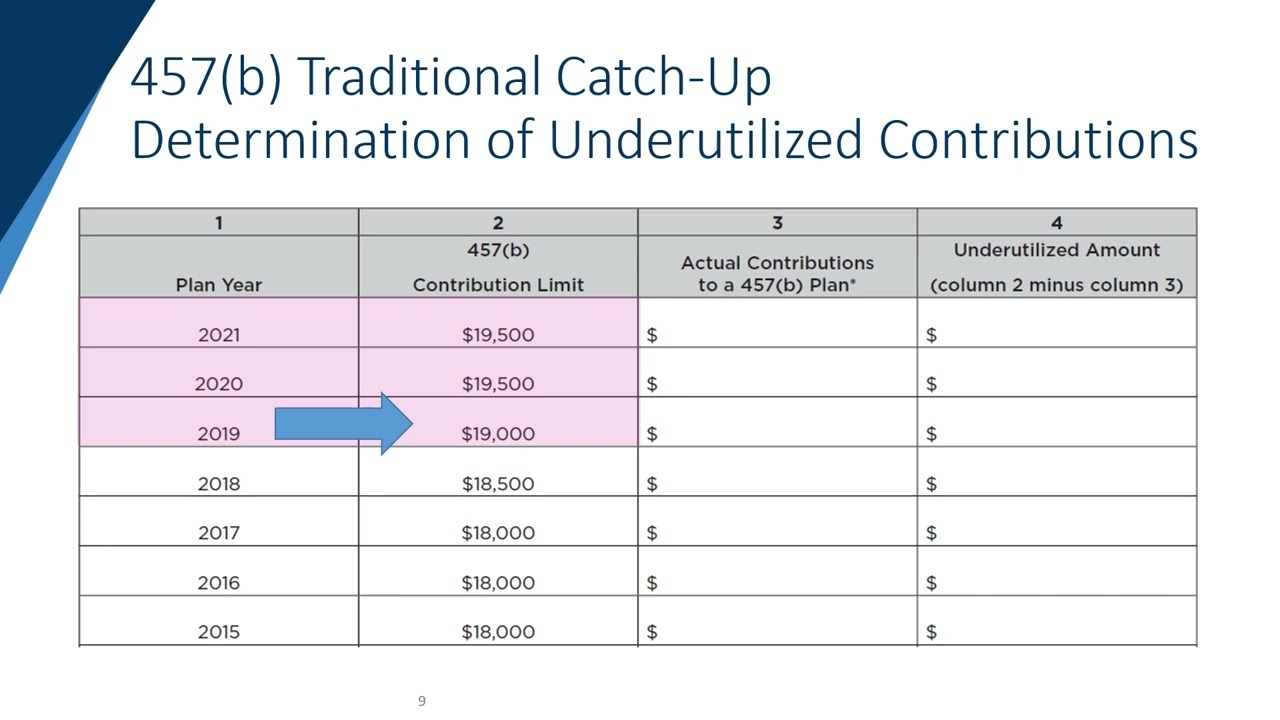

How to Fill out the 457(b) Traditional CatchUp Form YouTube, Those who are age 60, 61, 62, or 63 will soon be able to set aside. Eight kansas city chiefs who should expect to have a bigger role in 2025.

2025 Catch Up Limit Camel Corilla, Increases catch‑up limits to the greater of $10,000 ($5,000 for simple plans) or 50% more than the regular catch‑up amount in 2025 for individuals who have attained ages 60, 61,. Those who are age 60, 61, 62, or 63 will soon be able to set aside.

401k CatchUp Limits Increase in 2025 2025 401k Limit Changes and, 2025 preliminary inseason landings for species with stock annual catch limits (acl) date 2025 commercial landings through: Those who are age 60, 61, 62, or 63 will soon be able to.

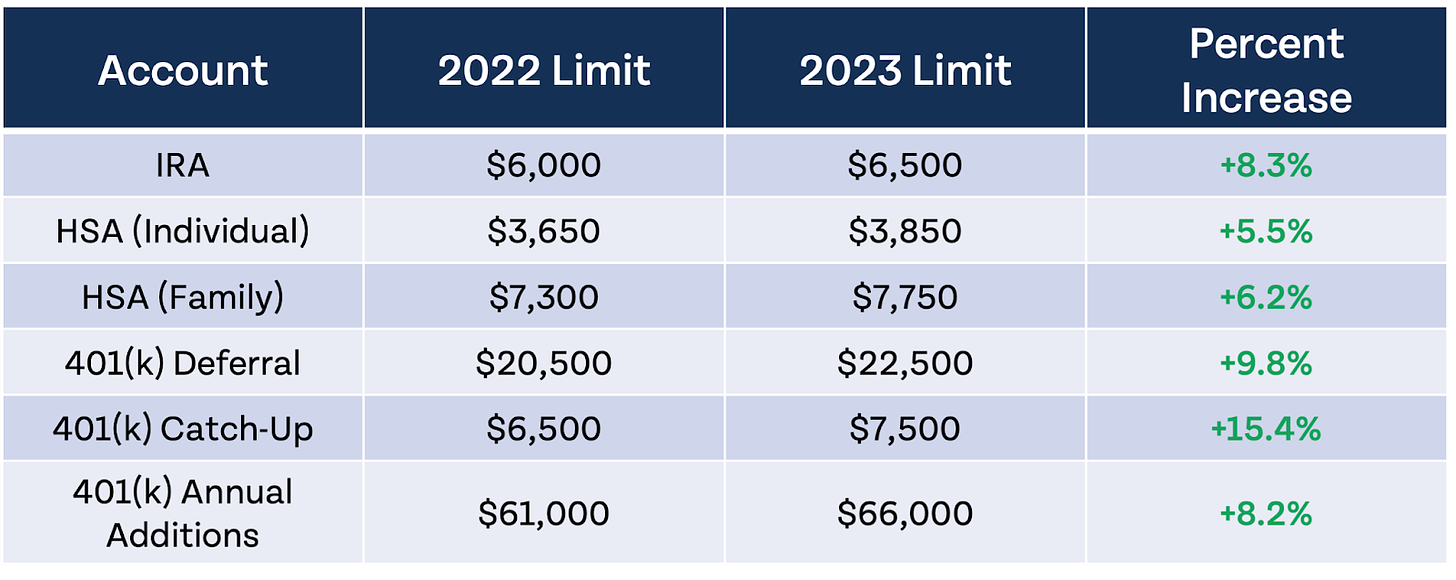

The IRS Just Announced 2025 Tax Changes!, Under the current irs regulations, the limit is $7,500 for 2025. 401k calculator with catch up contributions, that compares with the $500 boost seen in 2025 over 2025.

401k 2025 Contribution Limit Over 50 Johna Kirsten, Under the current irs regulations, the limit is $7,500 for 2025. Consumer product safety commission said it received reports of eight deaths and an estimated 9,700 injuries.

2025 Hsa Family Contribution Limits Layne Myranda, Those who are age 60, 61, 62, or 63 will soon be able to. In san francisco, all fireworks are illegal.

2025 Catch Up Contri … Ora Mellisent, Beginning in 2025, the limit for that group is equal to the greater. Under the current irs regulations, the limit is $7,500 for 2025.

401(k) Contribution Limits in 2025 Meld Financial, In san francisco, all fireworks are illegal. It is anticipated that the government may raise the income tax exemption limit to rs 5 lakh from the current rs 3 lakh limit under the new tax regime in the upcoming.

Consumer product safety commission said it received reports of eight deaths and an estimated 9,700 injuries.

In 2025, the contribution limit for employees who participate in traditional 401(k) plans is $23,000 a year if you’re younger than 50.